Yearly Percentage Charge (APR) represents the real annually Charge of one's loan, like any expenses or expenditures Along with the particular fascination you shell out towards the lender.

Assured Charge’s goal is to give their shoppers a “minimal, low price†on their own mortgages with transparent and honest fees, leveraging technologies to streamline and simplify the loan system, and providing unmatched services and pro suggestions to help you their shoppers find the proper mortgage. Their loan approach is often finished totally online, which includes electronic signatures.

When must I lock my mortgage charge? How to shop for a mortgage and Review mortgage rates Don’t settle for your to start with mortgage fee quote Exactly what is a mortgage charge lock? 5 strategies to acquire a reduced mortgage level thirteen Publishing Remaining Application Products on the Lender

When I purchase a home, when am i able to go in? How can I get my keys? Transferring into a new house: What you need to know Shifting recommendations: How to maneuver for a lot less Utility providers: How do I setup my new home? Get to understand your neighbors, Even though you’re shy When is my 1st mortgage payment due?

Just a purchaser that has booked by means of Booking.com and stayed within the property in issue can compose an evaluation. This allows us recognize that our evaluations originate from genuine friends, such as you.

The views expressed in contributions are These of Scheduling.com buyers and Qualities rather than of Booking.

USDA home value loophole. USDA loans let you take out a bigger loan than the purchase selling price In case the appraiser suggests the home is truly worth in excess of you’re having to pay.

You'll be able to apply for your USDA loan by SunTrust by going to the bank’s Web-sites, contacting to talk into a loan officer, or likely into a department spot.

Click below to apply for apply for a usda home loan ohio

produce an account, you unlock unlimited access to your lists from any Pc, pill or smartphone. They will not disappear right until you say so.

Prior to determining if a zero down mortgage is the proper choice for you, thoroughly think about the benefits and disadvantages, and decide what’s more likely to get the job done best with your problem.

Lenders can offer reduce desire premiums for USDA-backed loans than for conventional loans due to the backing by the government. Also, no down payment is required with a USDA loan.

We’re inside your Group, so we’re ready to provide you with locally-serviced loans that concentrate on you.

You need to demonstrate a valid photo ID and credit card upon Check out-in. Be sure to Take note that each one Specific requests cannot be guaranteed and are matter to availability upon check-in. Added fees may possibly apply. Parking is limited and readily available for cost-free on a first arrive, first served foundation.

Bankrate follows a stringent editorial plan, so that you can have confidence in that we’re Placing your interests first. Our award-winning editors and reporters create sincere and accurate information that may help you make the ideal financial selections. Essential Concepts We price your believe in. Our mission is to offer audience with precise and impartial information, and Now we have editorial specifications in position in order that takes place. Our editors and reporters extensively fact-Check out editorial material to be certain the information you’re looking at is correct. We keep a firewall among our advertisers and our editorial staff.

Putting zero down on a home is a real chance. No down payment for a first-time home purchaser puts homeownership within achieve for individuals who might not hold the signifies to avoid wasting for the down payment.

Becoming an knowledgeable consumer will help you learn what concerns to question And just how to understand the home acquiring course of action. It may also make it easier to establish and stay away from unscrupulous lenders and contractors that do not need your very best pursuits at coronary heart.

“Residual Revenue†for your sake of VA mortgage eligibility would be the money an applicant has remaining more than once their mortgage payment (PITI), motor vehicle payments, charge cards and any other revolving debt is compensated.

Our web page takes advantage of cookies. If you don't agree to this, it is possible to learn the way to vary your cookies settings. Examine more about cookies in this article. Additional use of This website is going to be viewed as consent.

Additionally the lender will operate a credit rating Look at on to obtain your credit history score. They'll also make sure the assets you need to finance is actually really worth the quantity of the purchase selling price.

Mason and Taylor Miranda desperately planned to purchase a house before beginning a loved ones. Their apartment was little, it absolutely was within an unsafe place, and it just wasn’t an acceptable destination to welcome their initially kid.

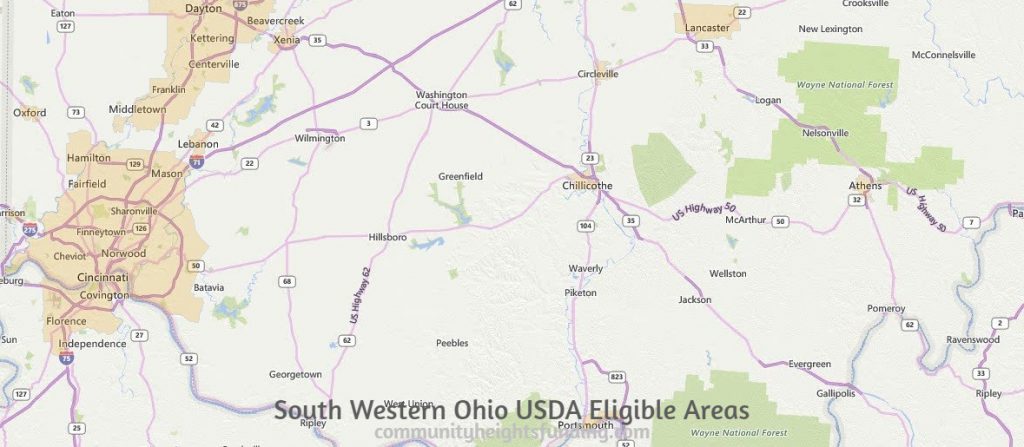

USDA Eligible Map In Ohio Region

The fabric offered on this Web-site is for informational use only and is not intended for monetary, tax or financial investment suggestions. get more info Lender of The united states and/or its affiliates, and Khan Academy, believe no legal responsibility for any loss or damage resulting from a person’s reliance on the fabric offered.

Inside the latter circumstance, you do a lot of the perform developing your house, and supporting Make Other people' homes, and in return it's not necessary to be worried about a down payment.

Definitely! When combining a hundred% of the purchase cost moreover the seller shelling out approximately 6% of the value in closing prices, it can be done for the buyer to provide no money in any way to closing.

Las solicitudes están disponibles ahora para las personas interesadas en solicitar alivio CARES para el pago de la renta o de la hipoteca debido a COVID-19.

Like a number of other homeowners, I investigated the heck out of shopping for my 1st home: what to search for in…

Feel it’s unachievable to order a home Until you may have 20% saved up? Possibly not. Minimal down payment alternatives might be much more typical than you think—if you know where to look.

A lower-down-payment tactic could allow you to acquire your home, but this means you may have much less equity, your regular payment is going to be better and chances are you'll shell out additional curiosity in excess of the life of the loan.

How am i able to buy a home with a VA-backed purchase loan? Purchasing a home is a complex course of action, and getting a VA-backed invest in loan is only one bit of the puzzle. Get Guidance for purchasing a home with a VA-backed loan